Becoming a homeowner isn’t as simple as picking out a house and making an offer. It’s a considerable investment, so the decision shouldn’t be taken lightly. Weeks or months of careful planning and research may be necessary to locate the perfect property for your needs.

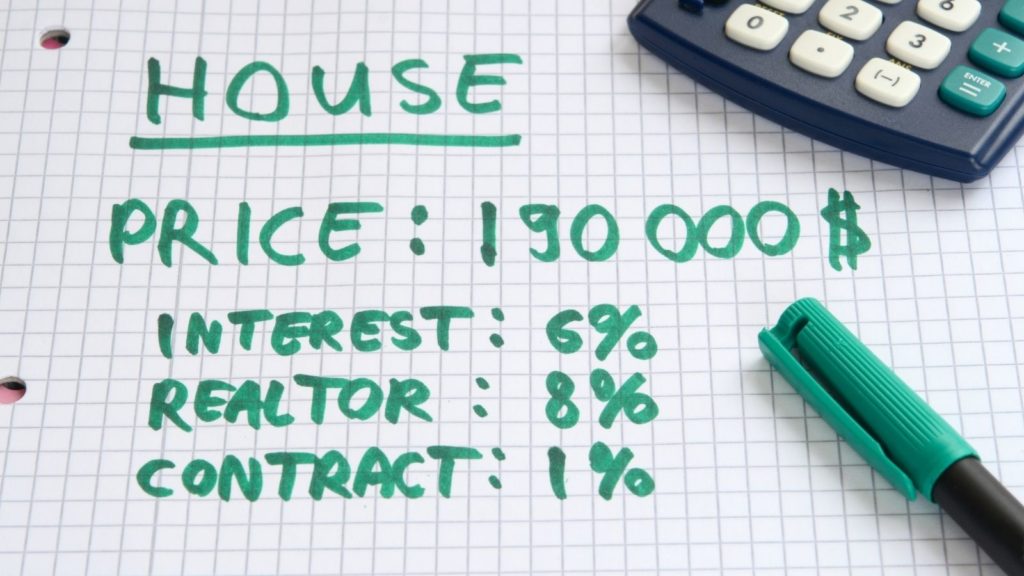

It’s a good idea to budget properly. Review your current income and expenses to learn just how much you can afford. You can start saving for your goal right away. Set aside a certain percent or dollar amount from each paycheck to put towards this goal. Remember that you’ll need to have enough funds for your down payment, monthly mortgage and utility bills, and closing costs.

Buying a home in North Carolina can take time. There are certain actions that need to be taken in a logical order and different people become involved at certain stages. You may even encounter delays or other issues. Patience, persistence, and a proactive plan of action can help you succeed.

Here are a few items that make up closing costs for home buyers:

1. Homeowner charges.

Escrow account fees, homeowner’s insurance and property taxes are common components of homeowner charges. If the house that you’re buying belongs to a homeowner’s association, association fees may also be part of these fees. This money is placed in an escrow account which is a temporary bank account. These accounts are usually opened and maintained for buyers by mortgage lenders.

Escrow account fees are assessed for opening escrow accounts. These accounts are used to deposit funds that will be used to pay for insurance and taxes. Homeowner’s insurance is required for most home sale transactions. The exact amount due can vary according to the policy and if other types of insurance are already taken out with the same company.

Property taxes are assessed by city and state government entities. They are charged based on the home’s perceived value and homeowners’ income. Homeowners association fees pay for snow removal, lawn care, and other maintenance aspects for properties that belong to a townhome, condominium, or other types of home association.

All taxes should be current since the house that’s being purchased will be used as collateral until the mortgage loan debt has been satisfied. Government offices can legally claim the property if those taxes aren’t paid. You can contact your county assessor or other respective local government offices to learn how much will be due for property taxes and when those taxes must be paid.

2. Lender charges.

Prepaid interest, discount points, loan origination fees and loan application fees make up most lender charges. Prepaid interest is charged daily for interest that accrues during the first month of the mortgage. It is only due for the number of days that remain during the first billing period. If your mortgage closes on June 15th, for example, interest will be due for the remaining 15 days left in the month.

Discount points are usually optional. They are used to lower the interest rate for a home loan. These points are typically charged at 1 percent of the loan’s total value for every quarter-point interest rate reduction.

Loan application fees are charged by lenders to process the loan application. Most application fees are anywhere from $200 to $500 on average, depending on the particular lender and the dollar amount of the loan. Loan origination fees are charged for starting the mortgage loan. They are generally about one to two percent of the loan’s total value.

3. Third party charges.

Mortgage insurance, tax service fees, credit report fees, and appraisal fees are third-party charges that are often associated with many home purchases. Mortgage insurance costs can fluctuate according to the individual situation. These policies protect the lender in the event that the borrower should default on their loan.

Tax service fees are relatively inexpensive. Most fees are $100 or less. They keep an eye on applicable taxes to ensure that they are being paid in a timely manner.

A credit report is usually requested by a mortgage lender. Credit report fees are generally less than $50 on average. Lenders will use the information included on that report to determine whether or not they can offer a home loan. You can also request a copy of your credit report. If there are any errors or inaccuracies, you can report or dispute them as needed.

Appraisal fees pay for the home appraisal. The property will be reviewed by an experienced appraiser. They will release a report indicating their evaluation of the house’s market value. This information can be used to determine if the seller’s asking price is reasonable. An appraisal generally costs no more than $500.

Some of the buyer’s closing costs may be paid by the seller. The seller could agree to cover certain fees so that the transaction can be expedited. Any such considerations should be included in the sale contract, so that they are easier to prove than verbal agreements if any disagreements surface later on.

Conclusion

Home buyers’ closing costs are typically around three to six percent of the home’s sale price on average. They can vary from one sale to another. You’ll also receive a closing statement from your lender that details all costs associated with the home loan.

Plan your purchase carefully and make an offer when you’re ready. You may want to get a preapproval letter before selecting a home. This document will include the dollar amount and terms that your lender is willing to offer to you. It doesn’t necessarily mean that you’ll be able to buy the house that you’ve had your eyes on. However, it can give you a distinct advantage over other interested parties who haven’t secured their financing just yet.

Once an offer has been accepted, it won’t be long until the sale has been completed. At closing, all final paperwork will be signed and filed. The seller will receive their payment for the proceeds. You’ll be given the keys to your new house and can move in whenever you want. Feel free to congratulate yourself on a job well done! It’s time to look forward to hosting parties, birthday celebrations, holiday get-togethers and other special events in a place that you’ll be glad to call home for many years to come.

Have Questions? Ask Liz!

Your real estate agent is the best source of information about the local community and real estate topics. Give Liz J. Holterhaus a call today at (252) 202-2156 to learn more about local areas, discuss selling a house, or tour available homes for sale.